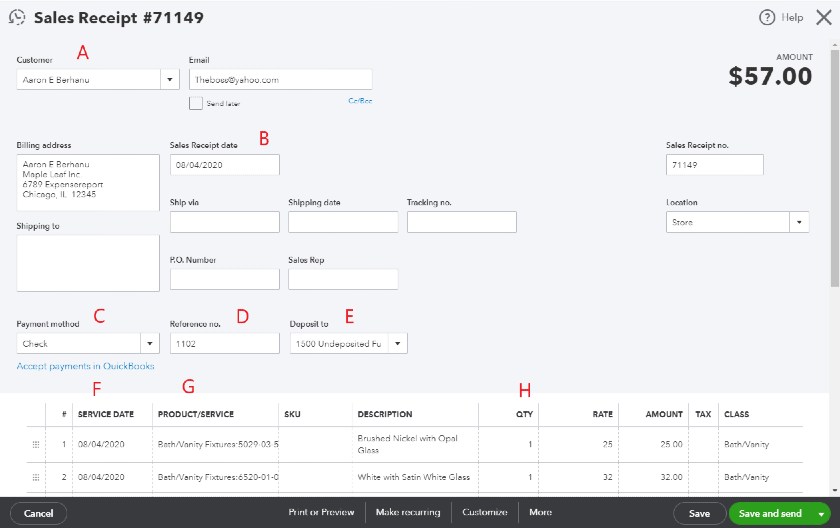

QuickBooks Online wouldn’t know which transactions to apply the payments against. Note that you can’t use Recurring Transactions for Invoice Payments or Bill Payments, because they are second stage. Recurring Transactions can be created for any first-stage transaction including Estimates, Sales Receipts, Invoices, or Expenses. Save existing transactions as Recurring by clicking the “Make recurring” button in the black bar at the bottom of the screen. Get creative! Where do I find it?Ĭreate new Recurring Transactions under Gear > Recurring Transactions. All bathrooms and kitchens have the same functions and appliances, so contractors can design comprehensive Estimates and update the details for each job.īecause there are so many options to set for a Recurring Transaction, it is extremely versatile. Pre-populated detailed Estimate templates.Don’t start from scratch every day or risk overwriting yesterday’s tapes. Point-of-Sale systems require daily sales and payment methods to be entered by journal entry or sales receipt. Thought that pesky Payroll Journal Entry wouldn’t just create itself? Now it will! Recurring Transactions can be scheduled to run automatically, remind you when it’s time to use them, or simply be stored as templates future use. Recurring Transactions is so flexible that you can get creative with it! By automating routine transactions, you will save hours of repetitive data entry, and even speed up your Accounts Receivable.

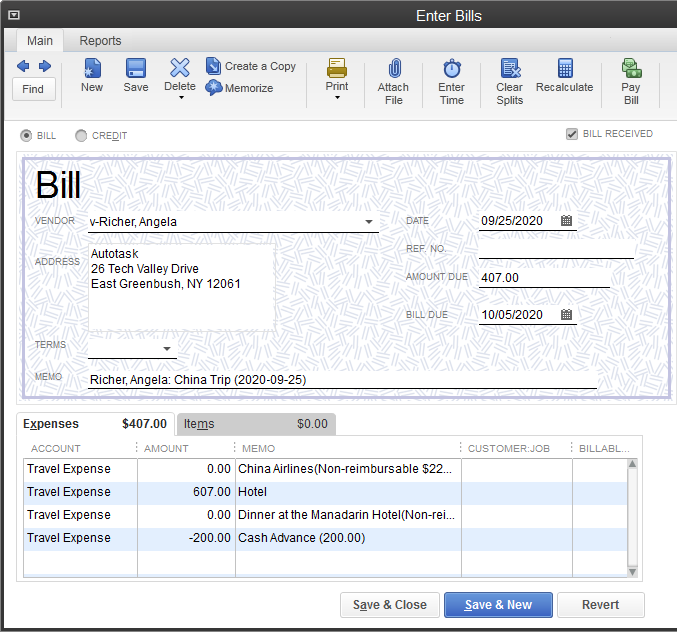

Recurring Transactions is a feature of QuickBooks® Online Essentials, Plus and Advanced that allows you to design transaction templates and reuse them. Type the reference number of the expense transaction and any business terms and conditions in the relevant fields, or skip this step if you don't need to record this information in your company accounts.Ĭlick the "Expenses" tab and select an account from the pull-down list for instance, select the "Marketing" expense account option to record a marketing expense transaction.Ĭlick "Save and Close" to record the expense and exit the window.Do you and your clients frequently recreate complex transactions from scratch, or open past transactions and copy them to create new ones? Do they invoice customers individually every month, and run their credit cards? Type the expense amount in the Amount Due input box. For example, enter the name of an ad agency or buyer if you want to record an advertising expense in your marketing expenses account.Įnter the date of the expense and the vendor's address in the applicable fields. Alternatively, click to select "Add New" and type a new vendor.

Select "Enter Bills" from the pull-down list of options.Ĭlick the "Down Arrow" button next to "Vendor" and choose an existing vendor from the list.

.png)

Click "Vendors" in the main menu at the top of the screen.

0 kommentar(er)

0 kommentar(er)